Unlocking the potential of exotic options

Exotic options, complex derivatives that differ from regular or “vanilla” options, are gaining increasing prominence in finance. These unique financial instruments possess characteristics and features that set them apart, making them an invaluable tool for savvy investors. With their versatility and potential for customisation, exotic options offer various strategies and outcomes that can significantly influence your investment approach.

This article will look into the potential of exotic options, providing a comprehensive understanding of their intricacies and exploring how they can effectively shape and enhance your investment strategy. By unravelling the complexities of exotic options, you can unlock a world of financial possibilities and elevate your financial decision-making to new heights.

Understanding exotic options

Exotic options are customised derivative contracts used in financial markets. Unlike their standard counterparts, these options offer investors a more extensive range of underlying assets, payoffs, and expiration dates. They are also known as non-standard or path-dependent options due to their complex structure and payout pattern.

Exotic options have been available for over four decades but were primarily traded over-the-counter (OTC). However, with the advent of electronic trading platforms and increased demand from sophisticated investors, these options have become more accessible.

Why are exotic options popular?

Exotic options offer investors who engage in Australian options trading a range of benefits that traditional options cannot. These include:

Increased flexibility

Exotic options allow investors to customise the terms of their contract to suit specific investment objectives, such as risk management or maximising potential returns.

Leverage opportunities

Some exotic options, such as barrier options, offer investors the opportunity to increase their leverage by providing a lower upfront premium than vanilla options.

Hedging capabilities

Exotic options can be used to hedge against market volatility, reducing risk exposure and protecting investments.

Higher potential returns

Due to their complex structure, exotic options have the potential for higher payouts than traditional options, making them an attractive investment for risk-tolerant Australian investors.

Diversification

Exotic options offer a broader range of underlying assets, including currencies, commodities, and weather patterns. It allows investors of Australian options trading to diversify their portfolios beyond traditional investments.

Types of exotic options

Numerous exotic options are available in the market, each with unique characteristics and potential benefits. Let’s explore some of the most popular ones:

Binary Options

These options, known as binary options, have a fixed payout if the underlying asset gets to a predetermined price before expiration. They are famous for their simplicity, making them accessible even to novice traders. With their potential for high returns, binary options offer an enticing opportunity for Australian investors seeking to potentially maximise their financial returns in the financial markets.

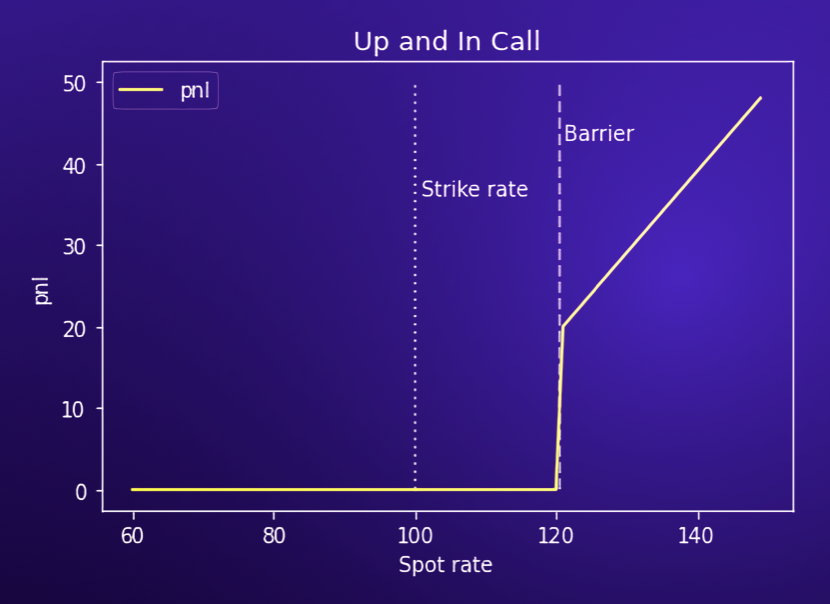

Barrier Options

Barrier options, a type of financial derivative, come in various forms, including knock-out and knock-in options. These options possess a barrier level, which, when reached, triggers a specific action. In the case of knock-out options, the contract is cancelled, while knock-in options become activated.

This unique feature of barrier options grants investors greater control over potential losses and returns, making them a valuable tool in risk management strategies. By setting predefined barrier levels, investors can tailor their investments to align with their risk appetite and objectives.

Asian Options

These options, known as average price options, have a payoff determined by calculating the average price of the underlying asset over a certain period rather than relying solely on its price at expiration. This innovative approach allows investors to mitigate market volatility risk by smoothing out short-term fluctuations and can be particularly beneficial for long-term investment strategies.

By incorporating the average price over a specific period, investors have a more comprehensive view of the asset’s performance, enabling them to make more informed decisions and potentially enhance their overall returns.

Lookback Options

Like Asian options, lookback options have a unique payout structure based on the underlying asset’s highest or lowest price during a specific period. This feature provides investors with increased flexibility in their investment strategies and has the potential to generate higher payouts compared to traditional options. By allowing investors to capture the extreme price movements of the underlying asset, lookback options offer an additional layer of opportunity and potential returns.

Risks Associated with Exotic Options

While exotic options offer numerous benefits, they also have their fair share of risks. Some of these include:

Complexity

The complex structure and payout pattern of exotic options can make them challenging to understand and evaluate, making it essential to consult a financial advisor before investing.

Liquidity

Since exotic options are not as widely traded as traditional options, they may have lower liquidity, meaning investors may need help finding buyers or sellers for their contracts.

Higher costs

Due to their customisation and complexity, exotic options may have higher transaction costs than traditional options.

Market volatility

As with any investment, market volatility can impact the value of exotic options. Sudden price changes in the underlying asset can result in significant losses for investors.

The bottom line

Exotic options offer a range of benefits that traditional options cannot match, making them a valuable tool for Australian investors looking to diversify their portfolios and manage risk. However, these options also come with their troubles, and it is crucial to understand them before investing thoroughly. As always, consult a financial advisor before making any investment decisions involving exotic options. With the proper trading and financial knowledge and strategies, you can unlock the potential of exotic options in your investment portfolio.